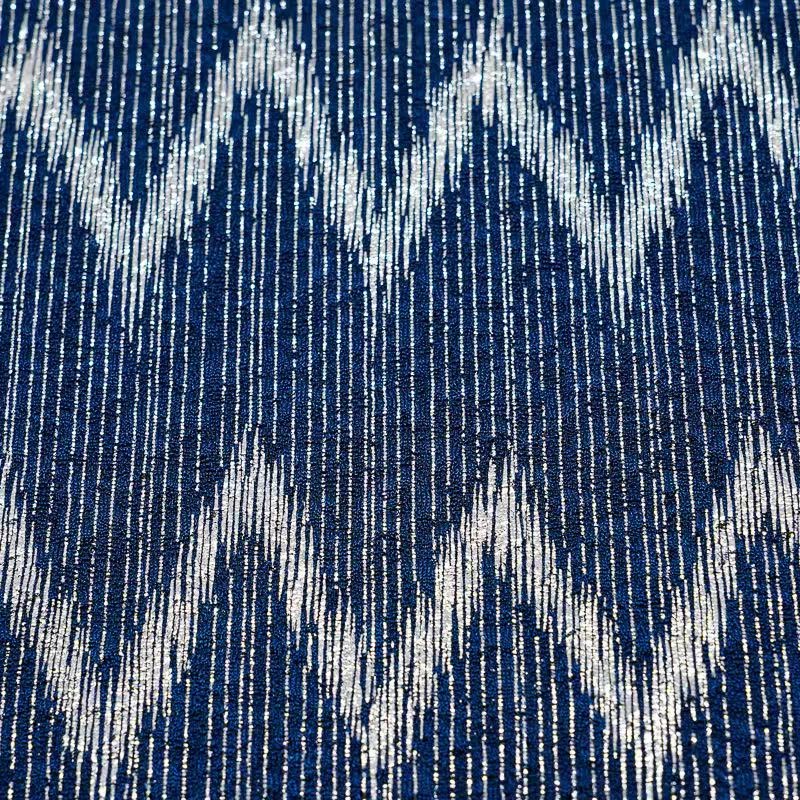

Recently, the international cotton trade market has witnessed significant structural changes. According to authoritative monitoring data from China Cotton Net, bookings for U.S. Pima cotton with an August 2025 shipment schedule have been continuously increasing, becoming one of the core focuses in the current textile raw material trade sector. In terms of specific transaction details, the current bookings are mainly for U.S. Pima cotton of 11-2 and 21-2 grades. These two grades of Pima cotton, characterized by long fiber length (usually 35-45 mm), high strength, uniform fineness, excellent dyeing performance, and fabric luster, are core raw materials for high-end textile fabrics (such as high-count and high-density shirt fabrics, luxury home textiles, and high-end sportswear). Their market trends directly reflect the demand changes in the global high-end textile industry chain.

The growth in bookings for U.S. Pima cotton is driven by the combination of multiple policy and market demand factors, which can be analyzed from three dimensions:

I. Extension of China-U.S. Tariff Moratorium: Reducing Trade Costs and Unlocking Procurement Demand

Previously, uncertainties existed in the tariff policies on textile raw materials and products between China and the United States. Due to concerns about rising tariff costs, some Chinese cotton textile enterprises adopted a “small-order, short-order” strategy for purchasing U.S. Pima cotton, with relatively strong wait-and-see sentiment. The latest 90-day extension of the China-U.S. tariff moratorium means that during this period, Chinese enterprises can continue to enjoy the original tariff preferences when importing U.S. Pima cotton, without bearing additional tariff costs, directly reducing the financial risks of raw material procurement.

From the perspective of industrial chain transmission logic, the extension of the tariff moratorium provides enterprises with a clear procurement window: On one hand, cotton textile enterprises can lock in Pima cotton orders for the August shipment schedule to reserve high-end raw materials in advance, avoiding potential cost increases caused by subsequent changes in tariff policies. On the other hand, trading enterprises have also increased their booking efforts, hoarding goods through bulk purchases to provide stable raw material supply for downstream fabric mills and clothing brands. This forms a dual procurement driving force of “enterprises proactively stockpiling + traders actively hoarding goods,” directly promoting the rise in bookings for the August shipment schedule.

II. Concentrated Placement of European and American Christmas Orders: Stimulating Demand for High-End Fabrics and Driving Raw Material Procurement

August to October each year is the peak period for placing Christmas orders in the European and American markets. During this cycle, European and American clothing brands and retailers need to complete the procurement, production, and transportation of Christmas season products (such as high-end knitwear, holiday dresses, and gift home textiles), leading to a seasonal surge in demand for high-end textile raw materials.

Specifically, European and American consumers have significantly higher quality requirements for Christmas season clothing compared to daily products. Especially in the mid-to-high-end market, the demand for fabrics made from Pima cotton is strong. For example, a European luxury clothing brand explicitly requires that the fabrics for its Christmas limited-edition shirts be woven with U.S. Pima cotton to enhance the texture of the products. High-end home textile brands in the United States also increase their procurement of Pima cotton bedding during this period to meet holiday consumption demand. The placement of such orders directly drives the procurement demand of downstream fabric mills for high-end cotton yarn, and U.S. Pima cotton, as the core raw material for high-end cotton yarn, naturally becomes the first choice for enterprises, thereby promoting a significant increase in bookings for the August shipment schedule (the shipment schedule matches the order production cycle: raw materials arriving in August can undergo spinning, weaving, and dyeing from September to October, and finished clothing products can be delivered before November to ensure they are on the shelves before Christmas).

III. Rising Expectations of “Rush Exports” in China’s Cotton Textile Industry: Layout in Advance to Seize Market Share

Based on the current market trends, the industry generally expects that China’s cotton textile and clothing industry will usher in a new round of “rush export” peak driven by these multiple positive factors. From historical data, due to similar policy and demand overlaps in the same period of 2024, the export value of China’s high-end textile and clothing products increased by 12% year-on-year, with the export proportion of fabrics using U.S. Pima cotton rising to 18%. In the first half of 2025, China’s textile and clothing exports have already achieved a 0.8% year-on-year growth, showing significant export resilience and laying a foundation for the “rush export” in the second half of the year.

Against the backdrop of rising “rush export” expectations, Chinese cotton textile enterprises have adopted a more proactive strategy: On one hand, enterprises ensure the production progress of high-end fabrics by locking in U.S. Pima cotton orders for the August shipment schedule in advance, avoiding delays in order delivery due to raw material shortages. In particular, European and American customers have strict requirements on order delivery schedules; delays caused by insufficient raw materials may lead to liquidated damages or order cancellations. On the other hand, some enterprises have also increased their Pima cotton procurement volume to expand the production capacity of high-end fabrics, in order to undertake more European and American Christmas orders and seize market share. For instance, a fabric mill in Zhejiang recently increased its procurement volume of U.S. Pima cotton by 30%, specifically for producing high-end shirt fabrics exported to Europe, and is expected to add 2 million yards of fabric export orders.

Looking ahead to the subsequent market trend, the demand for U.S. Pima cotton will remain at a high level in the short term (August to October): On one hand, the procurement demand during the tariff moratorium will continue to be released, and bookings for the September shipment schedule may further increase. On the other hand, the production cycle of European and American Christmas orders will continue until October, so the procurement demand for Pima cotton will not decline rapidly. However, it should be noted that if there are subsequent changes in China-U.S. tariff policies or if the European and American Christmas consumption demand falls short of expectations, it may have a certain impact on the market demand for U.S. Pima cotton. Chinese cotton textile enterprises still need to closely monitor policy and market dynamics, reasonably control raw material inventories, and balance procurement costs and market risks.

In addition, the growth in bookings for U.S. Pima cotton also reflects an important trend in the global textile industry chain: against the background of consumption upgrading, the demand resilience of high-end textile raw materials is significantly higher than that of mid-to-low-end raw materials. If Chinese cotton textile enterprises can continuously optimize their procurement and application capabilities of high-end raw materials, they will be more conducive to enhancing their competitiveness in the global high-end textile market and laying a foundation for further expanding high-end markets such as Europe, America, Japan, and South Korea in the future.

Post time: Aug-25-2025